Rivian has captured the spotlight in the electric vehicle market, sparking “fintechzoom’s Take on rivian:” curiosity among investors and auto enthusiasts alike. As one of the most talked-about names in EVs, Rivian is not just another player; it’s a pioneer with a bold mission to redefine how we think about sustainable transportation. With an impressive lineup that includes all-electric trucks and SUVs designed for adventure, this company is making waves in an industry ripe for transformation.

But what does this mean for potential investors? Is Rivian poised for long-term success or merely riding the current wave of interest in electric vehicles? In this blog post, we’ll dive deep into fintechzoom’s take on Rivian. We’ll explore its recent performance and growth potential while comparing it to other major players in the EV sector. If you’re contemplating whether to add fintechzoom rivian stock to your portfolio, stick around as we unravel what makes this company tick—and what risks lie ahead.

Recent Performance and Growth Potential of Rivian

Rivian has experienced a rollercoaster of performance since its IPO. The company initially drew significant attention and investment, showcasing ambitious production goals and innovative electric vehicles.

In recent months, Rivian’s quarterly reports have shown fluctuations in vehicle deliveries. Despite challenges, the company is ramping up production capabilities to fintechzoom’s rivian meet growing demand. They aim to increase efficiency at their manufacturing plant in Normal, Illinois.

Analysts are keeping a close eye on Rivian’s growth potential as it expands its lineup with new models like the R2 series. This move could enhance market competitiveness against established players.

The EV landscape is evolving rapidly, presenting both opportunities and fintechzoom’s rivian hurdles for Rivian. Continued investments in technology and infrastructure will be crucial for sustaining momentum moving forward.

Comparison to Other Major EV Makers

Rivian stands out in the crowded electric vehicle space, but how does it stack up against established giants like Tesla and newer entrants such as Lucid Motors?

Tesla remains the leader with its extensive market reach and brand recognition. Their Model S, 3, X, and Y dominate sales charts. Rivian’s focus on adventure-ready vehicles gives it a unique niche that appeals to outdoor enthusiasts.

Lucid Motors is another competitor emphasizing luxury and performance. Their Air sedan boasts impressive range figures that challenge Rivian’s offerings. However, Rivian captures attention with its R1T truck designed for rugged terrains.

When looking at production capabilities, Tesla’s vast infrastructure offers an advantage in scaling operations quickly. Rivian is still ramping up manufacturing but shows promise with its innovative approach to utility-focused EVs.

These comparisons highlight not just competition but also potential partnerships within this evolving industry landscape. Each player has distinct strengths shaping consumer preferences moving forward.

Fintechzoom’s Analysis and Recommendation for Investment

Fintechzoom’s analysis of Rivian reveals a promising yet nuanced investment opportunity. The company’s innovative approach to electric vehicles sets it apart in the crowded EV market.

With robust pre-orders and a focus on adventure-oriented models, Rivian is capturing consumer interest effectively. Their R1T truck and R1S SUV cater to an emerging demographic seeking eco-friendly alternatives without sacrificing performance.

However, potential investors should weigh the company’s current production challenges against its future goals. While Rivian has ambitious plans for scaling up manufacturing, execution remains critical.

The growing emphasis on sustainability also bodes well for Rivian, aligning with global trends toward greener transportation solutions. This alignment could drive demand as more consumers prioritize eco-friendliness in their purchasing decisions.

Investors considering fintechzoom rivian stock should remain vigilant about market dynamics while recognizing the brand’s unique value proposition within the EV landscape.

Risks and Challenges to Consider

Investing in Rivian comes with its share of risks. The electric vehicle market is notoriously volatile, influenced by competition and consumer demand shifts. Rivian faces significant pressure from established players like Tesla and new entrants.

Production challenges are another concern. Scaling manufacturing while maintaining quality has proven difficult for many automakers. Any delays could impact revenue projections and investor confidence.

Additionally, the supply chain remains a critical issue. Shortages of essential components can hinder production rates, especially in an industry that relies heavily on advanced technology.

Regulatory changes also pose potential hurdles. As governments worldwide implement stricter emissions standards, compliance costs may rise unexpectedly.

Market sentiment can shift rapidly as well. Investor enthusiasm might wane if Rivian fails to meet growth targets or deliver innovative products consistently.

Future Outlook and Potential Disruption in the Auto Industry

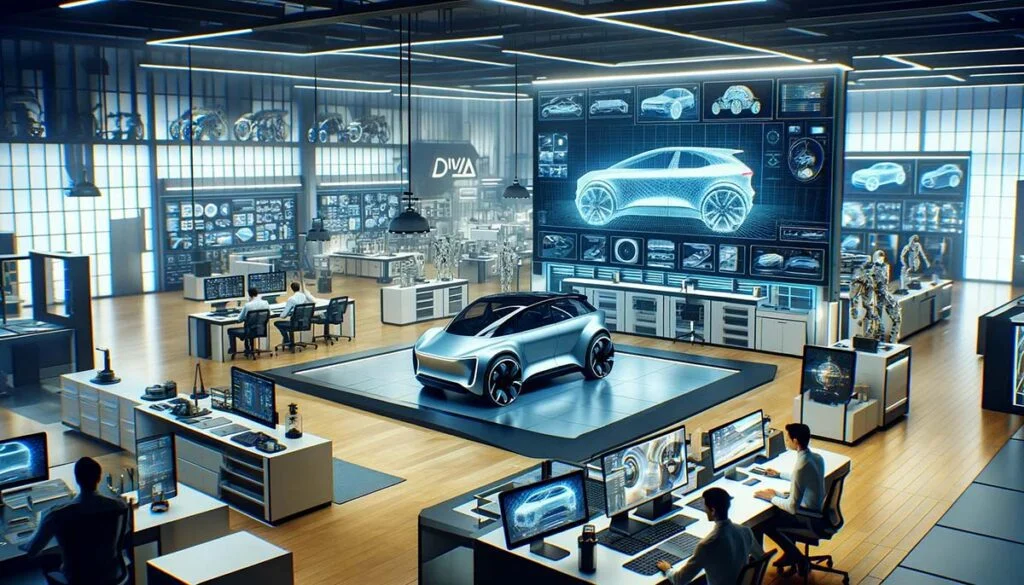

Rivian stands on the brink of transforming the auto industry landscape. With a commitment to sustainability and innovative technology, the company is not just another electric vehicle maker. It’s reimagining what vehicles can be.

As more consumers shift towards eco-friendly options, Rivian’s unique approach appeals to adventure seekers and urban dwellers alike. Their all-electric R1T truck and R1S SUV cater to diverse market needs.

The potential for disruption isn’t limited to product offerings alone. Rivian’s direct-to-consumer sales model challenges traditional dealership norms, reshaping how cars are bought and sold.

Additionally, partnerships with companies like Amazon bolster their logistics capabilities while enhancing brand visibility. This synergy positions Rivian as a formidable player in the growing EV market.

With advancements in battery tech and autonomous driving features on the horizon, Rivian could lead significant changes that ripple through automotive manufacturing practices globally.

Conclusion

Rivian has carved a niche for itself in the electric vehicle market, offering innovative designs and impressive performance. With their R1T pickup truck and R1S SUV gaining traction among consumers, the company showcases significant growth potential. The recent surge in its stock price indicates strong investor interest, but it’s important to analyze whether this momentum is sustainable.

When comparing Rivian to other major EV makers like Tesla and Ford, it’s clear that Rivian holds unique advantages in terms of product differentiation and brand loyalty. Their commitment to adventure-oriented vehicles resonates with a growing segment of environmentally conscious consumers who also embrace outdoor lifestyles.

Fintechzoom’s analysis shows that while Rivian presents an exciting investment opportunity, prospective investors should weigh its current valuation against future earnings potential carefully. The auto industry’s transition to electric vehicles is well underway; however, Rivian faces competition from established giants as well as new entrants looking to capture market share.

There are inherent risks associated with investing in any emerging technology sector. For Rivian, production challenges and supply chain constraints could impact revenue forecasts. Additionally, shifts in consumer preferences or regulatory environments might pose hurdles moving forward.

The future outlook for both Rivian and the broader EV industry suggests continued innovation will drive disruption within traditional automotive frameworks. As more players enter the space and charging infrastructure expands globally, companies like Rivian have the chance to redefine transportation norms significantly.

With these factors considered, investors interested in fintechzoom rivian stock should remain vigilant about market dynamics while keeping an eye on long-term trends shaping the electric vehicle landscape.